More and more people are using bicycles – after cars, they are the most popular means of getting to work. Young employees in particular appreciate it when their employer offers bike leasing: 76% of 18- to 29-year-olds are interested in a company bike.

As a benefit, it is interesting for employees of all company sizes and is also an attractive offer for freelancers. So, company bike leasing is absolutely in vogue and is a good opportunity for companies to act in an employee-friendly and sustainable way. For banks and lessors, this trend means a growing market with great potential.

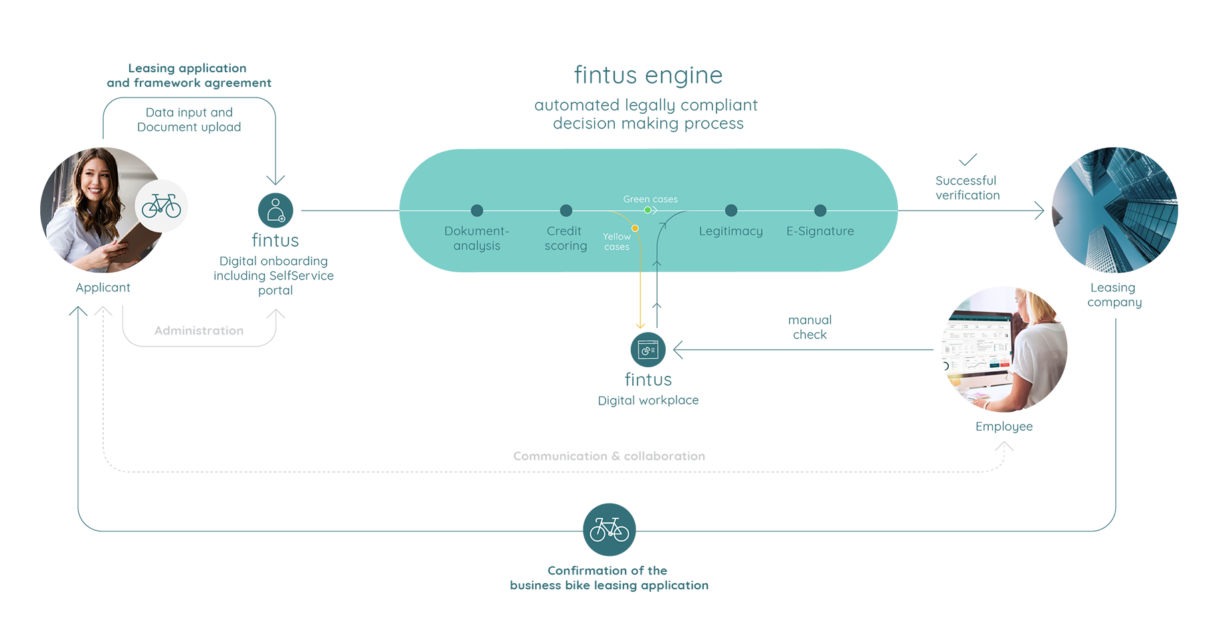

fintus offers the platform to optimize existing initiation, decision-making and leasing processes or to implement a new, professional process for business bike leasing out of the box – digitally optimized and in compliance with all regulatory requirements.

The process of leasing with multiple parties involved (employees, employer, lessor, dealer, manufacturer if applicable) is complex. Leasing companies must go through an extensive process until the contract is executed and paid. Completely paperless processing is often a long way off, and documents must be submitted, reviewed and evaluated. In addition, reliable legitimation and know-your-customer checks must be performed, credit decisions must be made, and its framework availability must be continuously checked. Thus, many specific sub-processes form a complex overall process between four parties:

In many leasing companies, the processes between the aforementioned parties are cumbersome and not very digital, let alone automated. Yet digitization and automation offer advantages and can sustainably conserve resources for all parties involved in the process. A lack of optimization not only means a lot of extra work for employees in the form of repetitive tasks, but also losses for sales partners and end customers in the customer journey and the provision of offers.

Both have to compensate for missing interfaces and weaknesses in the lessor’s process with a great deal of their own work and manual workarounds. Comprehensive digitization goes far beyond a visually attractive customer front end – only if the processes behind it are also digitally optimized can the speed of automation be profited from and a positive customer journey be generated.

Other challenges are the increased compliance and data protection requirements that must be observed and adhered to. Just requesting documents and proofs from prospects by e-mail? Actually unthinkable (but unfortunately still the rule).

In addition to the classic default risks, such as creditworthiness and solvency, there are other risk factors. Due to the increasing awareness of the importance of socially relevant topics such as compliance and sustainability, acting in accordance with the rules is particularly relevant for the formation and maintenance of one’s own image. For customers today, the credibility and social positioning of companies are important arguments when making purchasing decisions. It is therefore important to adhere to compliance rules in the leasing process and to ensure that money laundering and terrorist financing are prevented.

For these reasons, the following information, among others, must be reviewed before entering into a leasing agreement:

Despite or precisely because of the aforementioned requirements, a streamlined, optimized process can make business bike leasing profitable. A modular, digital end-2-end application route covers all sub-processes, checks and decisions and takes individual compliance standards into account. In addition, the two-way communication between the employees of the leasing company, the customer, the suppliers and the business bike users, which is necessary in exceptional cases, can be ensured in a legally secure manner.

The benefits of digital, automated, compliant leasing processes at a glance:

The fintus Suite offers all the technical components needed to implement business bike leasing in a professional and digitalized manner. Specialized in the requirements of banks and financial services institutions, fintus contributes its technical expertise to the targeted optimization of leasing processes.

This concerns both the automation of onboarding and legitimation processes prior to the conclusion of the contract as well as credit and framework checks during the collaboration and all ongoing regulatory and compliance checks that are to be mapped.

In addition, as a low or no-code platform, the fintus Suite can always be flexibly adapted to individual requirements.

The digital onboarding serves as a starting point for the trader (e.g. sole proprietors, partnerships, corporations). Ideally, the decision to accept the application is made while the necessary data is still being entered, relieving employees of the burden of checking applications and resulting in delighted customers. Subsequently, the company’s employees can optionally apply for bicycles independently via the fintus SelfService portal and are part of the digital platform.

The process is as follows for the applying trader:

The fintus solution offers a seamless, completely digital customer experience, transparent processes, fast decisions and a perfect interplay between automation and the targeted deployment of expert personnel.

Automatic decision? Positive? Good! For all other cases, we have the digital workplace. With a 360° view of documents provided, information obtained and even a view of complex corporate structures, it supports the processing of individual cases and yellow cases.

The internal component of the sustainably optimized leasing solution is the digital workplace from fintus. All collected data and information on customers and projects are stored in this workplace without having to exchange the core banking system. The digital workplace provides a professional work distribution and working environment for the employees of all involved departments.

This ensures effective communication, processing of tasks within the application process and team-oriented processing of financing requests.

Employees are only involved in the process in the event of unclear or negative decisions and to comply with the dual control principle. Tasks, notes and checks are automatically assigned to the responsible internal experts via the digital workplace and displayed in the intuitive front end. Part of the solution are document and contract creation, document display, notes, resubmissions and the view of all available data – 360° view in one software instead of ALT+TAB key in flight through the applications.

Compliance processes, whether legally mandated or self-imposed, are usually costly and time-consuming. In addition, the requirements are constantly changing. To automate processes in a legally compliant manner, you need a partner who understands the challenges and peculiarities of the finance and leasing industry and knows the current requirements. This partner is fintus – in addition to automating and digitizing processes, fintus also ensures reliable compliance with all regulatory and compliance standards with its banking-specific know-how, thus positioning itself as an expert for finance and leasing processes.

The regulations from the Money Laundering Act, Foreign Trade and Payments Act, Due Diligence Act, Basic Data Protection Regulation/DSGVO, various EU regulations or sanctions against persons, organizations and states ensure a complex overall situation in which companies operate. With fintus, the step of automatically checking these regulations can be easily implemented in the application process and customer support.

Customers can be supported by fintus in the KYC (Know your Customer) process. With automated processes, regulatory requirements and due diligence obligations under the Money Laundering Act and the German Banking Act can be reliably fulfilled. The KYC services of fintus’ technology partners serve to fulfill all regulatory obligations of customer identification as well as to comply with all due diligence obligations.

To make the most of the opportunities offered by business bike leasing, it is advisable to digitally map and automate the process route.

Since four central parties (leasing company, customer, supplier, business bike user) work together in the case of the leasing offer, additional third-party providers must be integrated for legitimation and creditworthiness checks, and compliance and regulatory requirements must be observed, business bike leasing is a challenging process in terms of automated mapping. It is advisable to work with a competent and bank-specific software partner to implement the fully automated end-2-end process.

The know-how for the leasing and finance industry is combined by fintus with established IT solutions that make the collaboration more efficient. fintus ensures automated, digital processes, faster decisions, reduction of costs and repetitive tasks as well as reliable protection against regulatory and compliance violations. All of this is offered by fintus out of the box and through its characteristics as a low or no-code platform with all the possibilities for customization and optimization of solutions.

Would you also like to benefit from the diverse possibilities and expertise of fintus? Get in touch with us. We would be happy to present our solutions for optimizing leasing processes to you personally.